Recent Articles

China and Hong Kong Markets – The Trade War

Ever since the trade war between China and the US began, there has been a lot of market uncertainty. As a result, there have been a ton of transactions between the Chinese Yuan and the American dollar, more so in the past few months. Many businesses and investors in the Chinese market are looking to buy into the dollar that seems to be strengthening by the day as a way to shield their assets from the looming foreign exchange risk. As they do this, there have been many speculations that the Chinese authorities are also looking for ways in which they can defend their currency, and this has also increased trades.Currency traders have confirmed reports that major state-owned banking institutions were working towards selling dollars so that they could defend the Yuan.

Most trades between the dollar and the Yuan take place on the spot market where they exchange soon after the deal takes place. However, they also take place in the case of futures trading where parties agree to carry out the transaction at another date at a set price. Traders are also looking into ways in which they can benefit from these transactions as they take into account the risks that come about in futures trading. Commodity traders have increasingly expressed interest in hedging the risks to which they are exposed owing to the ongoing tariff battle.

The People’s Bank of China is responsible for controlling the price of the Yuan within the mainland borders. However, the value of the currency while in the markets is beyond their control. Both values have declined in the past months regarding the dollar. At present, the dollar has witnessed an increase of 7 percent in comparison to the Yuan. As this takes place, centers of dollar-yuan currency futures have reported an increase in volumes, more so in Singapore and Hong Kong. This increase is expected to keep soaring as investors find means by which they can protect their interests as the war continues.

New Report on RINO International

Muddy Waters came out with a new report on RINO International this morning. As in ONP, they do an excellent job providing compelling evidence that RINO is fabricating its SEC financial statements. Here is an excerpt of their summary from the first page:

- RINO’s FGD sales (60% to 75% of revenue) are much lower than it claims. We found that many of its customer relationships do not exist.

- Chinese regulatory filings show that RINO’s consolidated 2009 revenue was only $11 million, or 94.2% lower than it reported in the US. We show that the Chinese numbers are credible.

- RINO’s accounting has serious flaws that are clear signs of cooked books.

- RINO’s management is draining cash from the company for its own business and personal uses. The management is in flagrant breach of its VIE agreements, which require it to pay income to RINO (as opposed to taking it).

- RINO’s balance sheet has an astonishingly small amount of tangible assets for a manufacturer. Rather, it is filled with low quality “paper” assets that balance out the inflated earnings, and likely hide leakage.

- RINO is not the industry leader it claims to be in the steel sinter FGD system market. Rather, it is an obscure company in a crowded field, and is best known for its failed projects. Its reported margins are two to three times what they really are. Its technology is sub-par.

- We are not sanguine about management “borrowing” $3.2 million to purchase a luxury home in Orange County, CA the day that RINO closed its $100.0 million financing.

It’s an excellent report and an example of yet another fraud in the U.S.-listed RTO china space.

Wonder Auto’s Wonderless Acquisition

The research firm OLP Global came out with an excellent research report on Wonder Auto Technology, Inc. (WATG) last week.

The report examines a $15 million acquisition that the company made in July 2010, and raises serious questions about whether the acquisition was legitimate.

Acquisition Overview

In its second quarter 10Q, the company announced it acquired Vital Glee Development Limited (“Vital Glee”) for $15 million on June 24, 2010. Vital Glee was an “investment holding company and through its subsidiary engaging in automotive shock absorber manufacturing business”.

“On June 24, 2010, [WATG’s subsidiary] agreed to acquire 100% equity interest in Vital Glee Development Limited (“Vital Glee”), for a total consideration of $15 million of which $8.7 million was settled in June 2010. The remaining consideration will be divided into 2 equal installments and will be settled by December 31, 2010 and June 30, 2011 respectively. The Company obtained control over Vital Glee on July 1, 2010 by appointing the sole director to Vital Glee. Vital Glee is an investment holding company and through its subsidiary engaging in automotive shock absorber manufacturing business.”

Little additional disclosure was given, in the 10Q or any subsequent SEC filings.

OLP investigated the acquisition further. From speaking with management, OLP determined that Vital Glee’s operating entity was Jinzhou Lide Shock Absorber Co., Ltd. This is further confirmed by a Roth Capital report on September 30, 2010.

After some investigation, OLP found serious issues with the acquisition, which I will summarize below:

1. Jinzhou Lide was formed in April 2010

According to the AIC records for Jinzhou Lide, which are included in the OLP research report, Jinzhou Lide was established on April 26, 2010. You can also see this on the Jinzhou AIC website here (use Google Chrome’s translation functionality if you cannot read chinese).

I’m doubtful that a business that has been operational for 2 months can be worth $15 million.

Management told OLP that Jinzhou Lide was formed from a reorganization of an older company, which engaged in the same auto shock absorber business in Jinzhou. Management, however, declined to provide the name of Jinzhou Lide’s predecessor company, and I discuss below my skepticism around management’s claim.

2. Jinzhou Lide was established at the same address as another facility owned by WATG

According to AIC records (see page 4 of OLP report or the website I show above), Jinzhou Lide was established and located at:

Bohai Street, Jinzhou Economy & Technology Development Zone, Jinzhou, Laoning

This is the same address of Jinzhou Wanyou Mechanical Parts Co., Ltd., a subsidiary of the company. OLP learned this by calling the company, but you can look on this site, this site to verify that Jinzhou Wanyou is located at Bohai Street, Jinzhou Economy & Technology Development Zone, Jinzhou, Laoning. Or simply search for the chinese characters of the address and the chinese characters of Jinzhou Wanyou Mechanical Parts Co., Ltd., which are found on pages 3 and 10 of the OLP report, respectively, in Google Chrome.

Not surprisingly, we also see this address show up in this 8k from April 4, 2007, where Jinzhou Wonder Auto Suspension System Co., Ltd. sells a stake in Jinzhou Wanyou Mechanical Parts Co., Ltd. to WATG. Click here for the relevant page showing the address. Jinzhou Wonder Auto Suspension System Co., Ltd. is shown as a related party throughout several historical SEC filings, such as its 2007 10K.

We now see that WATG paid $15 million for a subsidiary that was two months old and established at the same address as one of WATG’s current facilities.

3. Jinzhou Lide had a registered capital of only $1.2 million, and yet was sold for $15 million two months after being established

Jinzhou Lide’s registered capital is only $1.2 million, which implies that its shareholders only put in $1.2 million in April 2010 to establish the business. Yet it was sold to WATG for $15 million in July 2010. I’m doubtful that Jinzhou Lide’s value rose 1,200% in its two months of operations.

4. Management has not disclosed the identity of Vital Glee’s seller

In the vast majority of M&A transactions, investors are aware of the identities of both the buyer and seller. In this case, WATG management has not disclosed the identity of the seller, and investors cannot determine the identity of the seller through any other means. Vital Glee is registered in the British Virgin Islands (BVI), and the BVI registered agent will only release the director and shareholder information if Vital Glee management consents. Upon OLP’s request, the BVI registered agent sought permission on multiple occasions from Vital Glee management, but has yet to receive approval to release Vital Glee’s shareholder information.

OLP also asked WATG management to identify the name of the seller. According to OLP, the WATG CFO stated that he does not know the identity of the seller.

The question therefore remains: who owned Vital Glee and who received the claim to $15 million upon its sale?

WATG should publicly disclose the identity of Vital Glee’s sellers, and enable investors to independently access the relevant information from the BVI registered agent.

5. Jinzhou-based sources in the auto parts industry were unable to identify Jinzhou Lide’s predecessor, and weren’t aware of M&A involving any $15 million shock absorber businesses in Jinzhou

OLP identified 14 companies in the auto shock absorber business located in Jinzhou that have effective AIC registrations. They are listed here. OLP spoke to “numerous” members of this list in an effort to identify Jinzhou Lide’s predecessor and none of them were able to identify a company that could have been Jinzhou Lide’s predecessor.

Additionally, none of the sources were aware of a $15 million acquisition in the auto shock absorber sector in Jinzhou.

Conclusion

We have seen corporate governance issues and questionable financial and management practices at other Chinese RTOs structured and financed similarly to Wonder Auto. Like others, Wonder Auto has not chosen a top-4 auditor, instead choosing to go with PKF Hong Kong, a firm that boasts only 4 partners. Like others, Wonder Auto has eye-popping financial figures, claiming 40% to 50% revenue growth annually since 2005 and 20%+ operating income growth during that same time period, which imply extraordinarily high returns on capital on its capital expenditures and acquisitions. During the global downturn of 2008 and 2009, which impacted China just like the rest of the world, WATG doubled both revenue and gross profit, and increased EPS by 40%. The company has raised substantial amounts of dilutive equity at low valuations, such as $69 million in November 2009 at a valuation of less than 15x PE.

The facts behind the Jinzhou Lide acquisition are damning. WATG appears to have paid $15 million for a 2-month-old company established at the same site as one of WATG’s other subsidiaries. WATG has yet to disclose the seller of Jinzhou Lide, and its general disclosure of the acquisition is noticeably sparse. Numerous local competitors are unaware of a shock absorber business in Jinzhou that could have been the predecessor to Jinzhou Lide. They also have not heard of a $15 million acquisition in the sector. The shock absorber business community in Jinzhou is small enough that such a predecessor and acquisition would not go unnoticed.

If management wants to prevent further allegations of fraud, it should release an 8K elaborating on the details of the Jinzhou Lide acquisition. It should provide predecessor financial statements of Jinzhou Lide; the identity and backgrounds of its sellers; an explanation of why its initially registered address is the same as one of its subsidiary’s; a list of customers; and additional information that would allow independent analysts to verify Jinzhou Lide’s legitimacy.

CHBT vs SPRD: A Tale of Two AIC Filings

Over the past few months, the topic of financial filings with China’s State Administration for Industry and Commerce (SAIC) has made frequent appearances within the U.S.-listed Chinese RTO (“reverse takeover”) sector. I and other critics have advocated that AIC filings are important data points in determining whether certain Chinese RTOs are falsifying their SEC financial statements. In cases where AIC-reported revenue, profit and assets are substantially lower than SEC-reported financial figures, we’ve claimed that this provides material evidence that the companies in question are fabricating their SEC financials.

Our arguments have made sense to many investors, but some remain unconvinced. Misleading responses by certain of the alleged frauds that AIC filings don’t matter have muddled the debate. These companies, such as CMFO, LIWA or CSKI, have claimed that AIC filings are unimportant and are not taken seriously in China, and that investors should not use these filings as data points when analyzing U.S.-listed RTOs. I strongly disagree.

The point of this article is that AIC filings do matter.

To illustrate this point in a way that hasn’t been yet done, I’m going to provide full 80-page AIC filings on two Chinese companies, China-Biotics Inc. (CHBT) and Spreadtrum Communications Inc (SPRD). Both of these companies listed on the U.S. public markets several years ago, trade at similar market capitalizations, and both file with the Shanghai branch of the Administration for Industry and Commerce (“AIC”). Unlike some AIC branches that provide only selected AIC documents, the Shanghai branch provides full AIC reports to inquiring investors.

The China-Biotics filing is 84 pages, while the Spreadtrum filings are comprised of one 76-page filing and one 34-page filing. I also provide full English translations for each filing. These filings and the English translations help address much of the misinformation circulated about AIC filings, and provide clear examples of what information is included in AIC reports, and why I’m confident that these numbers matter. The filings provide extensive information about each company’s ownership, registered capital, and, most importantly, audited financial statements filed with the local Chinese government.

As I’ll discuss, Spreadtrum’s AIC report and financial statements provide evidence that SPRD is a legitimate Chinese company that generates substantial revenue and owns a significant amount of assets. Their filings give investors comfort that the company is accurately representing itself in its SEC financial statements.

CHBT’s AIC report and financial statements, on the other hand, indicate a company that is far smaller than its SEC filings indicate. Whereas SPRD’s AIC filings show a company generating more than $100m of revenue, CHBT’s filings show a company generating less than one-tenth of its SEC-reported revenue.

Both companies file with the same local AIC office. The reports are in the same format, and include similar sets of documents. Yet one shows a legitimate company, and the other shows a legal entity that has minimal business operations. Any long investor in CHBT, or critic of the legitimacy of AIC filings, has to ask himself the following question: why would CHBT provide false information in its AIC filings when SPRD doesn’t?

The answer is that CHBT management is providing accurate information to the AIC. The fake information is in the SEC filings they provide to public investors and the U.S. government, a government that does not have legal recourse to Chinese residents.

Currently, the public markets are valuing CHBT and SPRD similarly. CHBT has a market capitalization of $315m. SPRD has a market capitalization of $440m. Yet one of these Shanghai-based companies is real and the other is a fraud.

Brief background on AIC filings, and why I’ve chosen CHBT and SPRD

For those new to the debate, I’ll provide a brief discussion of AIC filings. The State Administration for Industry and Commerce is the Chinese government agency responsible for drafting and implementing legislation concerning the administration of industry and commerce in China. SAIC regulations are implemented by local AIC branches.

All Chinese companies file a variety of information with their local AIC office, including information on property leases; land use rights / building ownership certificates; capital verification reports (these show money / assets contributed by whom, and when); business licenses; the approved “business scope”; the legal representatives; applications to form the companies, with some personal information on the applying shareholders; applications to raise / reduce capital or change the business scope or term; tax and other government incentive documents; company bylaws; and, last but not least, annual financial statements.

Not all AIC branch offices operate the same way. Some provide photocopies of original documents to inquiring agents. Others email electronic data sheets. And others either provide information only verbally or require agents to visit the office and transcribe the relevant information by hand.

Furthermore, not all AIC branch offices provide the same volume of information to outsiders. Some AIC branch offices provide no information at all to the public. Some provide just financial statements. And some provide extensive reports, including financial statements, capital registrations, leases, etc.

The Shanghai AIC is one of those branches that provide full AIC reports, and in a convenient PDF document that is comprised of photocopies of all the relevant source documents.

That is why I have chosen to compare CHBT and SPRD. Both of these companies report to the Shanghai AIC. Unlike CMFO or ONP, which report to small rural AIC offices that are more secretive in terms of what they release to the public, the Shanghai AIC provides exceptional disclosure to inquiring investors.

CHBT vs SPRD

CHBT

Click here for CHBT’s AIC report translated into English.

The AIC report is 84 pages, and I’ve numbered the pages clearly in the bottom right-hand corner of each page. Here is a breakdown of the documents contained in the report:

- Page 1-9: Company bylaws

- Page 10-11: Registration of the company name and application to register the company (July 1999)

- Page 12-19: Lease of Pudong plant (August 1999)

- Page 20-41: Various registration documents from 1999 to 2005

- Page 42-50: Various registration documents related to transfer of ownership from management to Sinosmart Group, the BVI entity involved in the reverse merger, in 2005

- Page 51-67: Annual Inspection Report for Foreign-Funded Enterprises for 2007

- Page 68-84: Annual Inspection Report for Foreign-Funded Enterprises for 2008

There should be little doubt that this AIC filing is for Shanghai Shining Biotechnology Co., Ltd, the main operating subsidiary of China-Biotics, Inc. Here is CHBT’s organizational structure:

Growing Bioengineering (Shanghai) Co., Ltd. is the legal entity established in 2006 that owns the bulk additives operations. Our AIC filing comparison is for the years 2007 and 2008, when Growing Biongineering had no material operations. Shanghai Shining was the sole operating entity. The 2009 filings for Shanghai Shining are not yet available.

SPRD

Spreadtrum is a semiconductor manufacturer that IPO’d in 2007. It had a rough 2008 and 2009, when the global downturn reduced semiconductor demand, but business appears to be rebounding. Its two largest institutional investors, each owning more than 10% of shares, are $14bn private equity firm Silver Lake Partners and $11bn venture capital firm New Enterprise Associates.

SPRD, like most companies that generate $100m+ of revenue, has more than 1 operating subsidiary. Based on discussions with management, most of the revenue, profit and assets were generated at two subsidiaries in 2007 and 2008: Spreadtrum Communications (Shanghai) Co., Ltd. and Spreadtrum Communications Technology (Shanghai) Co., Ltd. I’ll refer to the former as “Spreadtrum Communications” and the latter as “Spreadtrum Technology”.

I’ve acquired and translated the AIC filings for both of these subsidiaries.

Chinese GAAP does not consolidate financial statements. To approximate the consolidated financial figures for SPRD, we need to add the figures of Spreadtrum Communications and Spreadtrum Technology. Naturally, there are intercompany payments between the two subsidiaries that distort revenue and profitability. As well, the assets and liabilities are distorted by dividends payable to other SPRD subsidiaries, as well as the SPRD parent. But for our purposes, it’s clear that these AIC filings show a real company with assets and revenue greater than $100m.

Financial Comparisons

Let’s compare the financial figures between each company’s AIC filings and SEC filings:

CHBT comparison:

SPRD comparison:

In the case of CHBT, the AIC filings show revenue of less than $1m in 2007 and 2008. This compares to SEC-reported revenue of $31m in 2007 and $42m in 2008. CHBT’s AIC-reported total assets were $7m and $9m, compared to $45m and $94m in its SEC filings.

CHBT’s AIC financial statements are on pages 51 to 84 of the AIC filing . A summary for 2007 and 2008 are on pages 53 and 70 of the filing .

In the case of SPRD, Spreadtrum Communications reported revenue of $62m and $64m in its 2007 and 2008 AIC filings, while Spreadtrum Technology reported revenue of $112m and $91m its 2007 and 2008 filings. Together, the combined entities reported $174m and $155m of revenue in 2007 and 2008 in their AIC documents. The SEC-reported revenue for SPRD was $146m and $110m in 2007 and 2008. The higher combined AIC numbers indicate that there were some intercompany sales in the AIC filings. Total assets for the combined two entities were $116m and $126m in 2007 and 2008, compared to SEC-reported total assets of $237m and $153m. The discrepancy in assets is likely due to large cash balances and other holdings at the non-Chinese parent Spreadtrum Communications, Inc., or other subsidiaries. Again, we shouldn’t expect these subsidiary financial statements to match the SEC filings; rather, we’re mainly looking to see if the SPRD AIC filings indicate that there is a legitimate business operating under the SPRD ticker. They do.

Do We Have the Right Shanghai Shining Biotechnology Co. Ltd?

There is boundless evidence that the 84-page filing I’ve included refers to the same Shanghai Shining that is CHBT’s main operating subsidiary.

The shareholders of the company in the AIC filings are Song Jin’an, Yan Li, Huang Weida, and Yan Yihong. Jin’an is the current CEO, Li is his wife, Yihong is her sister, and all four are current or former officers, directors or shareholders of CHBT according to its SEC filings.

The main company address listed in the AIC filing is the same as the one listed in the SEC filing.

The CEO’s signature in the AIC filing is the same as the CEO’s signature throughout SEC filings. For instance, compare Song Jinan’s signature on this page from CHBT’s 2006 10K with his signature on page 19 of the AIC filing.

The percentage ownerships of the shareholders prior to the reverse merger match the percentage ownerships that China-Biotics has disclosed to the SEC. For instance, compare the response to question 14 in this March 16, 2007 correspondence with page 37 of the AIC filing .

Pages 43 to 50 of the AIC filing provide details on management’s transfer of ownership to Sinosmart Group, the British Virgin Islands legal entity that acted as an intermediary in the company’s 2006 reverse merger. That transaction is documented extensively in the company’s SEC filings – search Sinosmart in any 10K.

There should be little dispute that we have the correct entity.

Evidence for why AIC filings do matter

I don’t think any aspect of our AIC filings gives the impression that companies can outright lie in the financial statements they file with the AIC. Each company provides lengthy and accurate information on their registered capital, leases, shareholders, company bylaws, etc. It’s a tremendous leap of faith to believe that the AIC requires accurate reporting in these aspects, but is indifferent as to whether a $40m revenue company reports sales of only $1m in its financial statements.

Here are additional reasons why we should take CHBT’s AIC filing seriously.

1. CHBT management live in China. The AIC filings are filed with the Chinese government, whereas the SEC filings are filed with the U.S. government. Management is concerned about violating Chinese law and providing false information to the Chinese government. But they are indifferent to defrauding the US government and breaking US law. A Chinese resident does not have to obey U.S. law any more than a U.S. resident is required to obey Chinese law. That’s why they report the accurate numbers to the Chinese government, and the fake numbers to the U.S. government. There are practically no repercussions to Chinese management teams that defraud foreign investors. Numerous U.S.-listed RTO companies, like CXTI, CYXI and CHFI, have seen their management teams vanish with the companies’ assets, and suffer no legal repercussions. Defrauding U.S. investors is not a violation of Chinese law, whereas defrauding the Chinese government is.

2. The AIC financial statements are audited. The audit reports can be found on pages 56-57 and 73-74. Click here for English translations of these pages.

3. On page 70 (English translation is here), near the front of the 2008 Annual Inspection report, we have a picture of Yan Yihong (the former CFO and sister-in-law of the CEO), along with her detailed personal information and the following testament:

I hereby confirm and promise that all the contents contained in the annual inspection report do not contain any fraudulent information and all the financial statements and other materials submitted are true and effective, and that I’m willing to bear any legal and related responsibilities caused due to the inaccuracy of such documents.

This is followed by the signature and personal seal of CEO Song Jin’an, as well as a seal of the company. I can’t fathom how the Chinese government would require such a testament in the Annual Inspection Report, but then allow a company to file false financial statements.

It’s far more believable that CHBT is defrauding the US government and US investors, both of which have no legal recourse to the company’s management. The Chinese government certainly has legal recourse to Yan Yihong and Song Jin’an. The existence of this sort of testament at the front of the AIC Annual Inspection reports is a strong sign that AIC financial statements do matter.

4. Why does SPRD file financial statements that approximate its SEC filings (intercompany distortions notwithstanding), while CHBT files financial statements that are a tiny fraction of its reported SEC filings? As I’ll discuss in future articles, there are ample other signs that SPRD is a real business, while CHBT is not. But even excluding any such future arguments, why would one foreign-owned Shanghai company lie on its AIC financial statements when another would tell the truth? Why would SPRD report large, accurate numbers if these filings didn’t matter? What sort of reasonable explanation can anyone come up with? Either both should be understating their numbers, or both should be reporting accurate numbers.

I firmly believe that both are reporting accurate numbers in their AIC filings.

The fake numbers are the ones in CHBT’s SEC filings.

Conclusion

Naturally, AIC filings are not the only signs that CHBT is falsifying its SEC financial statements. Citronresearch raises excllent non-AIC-related issues with the company here. The notion that probiotics nutritional supplements allowed CHBT to achieve revenue growth of 30%-50% annually over the past 4 years while achieving Microsoft-like EBITDA margins of 40%-45% is nothing short of absurd. The company raised $75m of cash in 2009 when it already supposedly had that much sitting in the bank, with no compelling reason for the new capital raise and dilution. Its reverse merger was organized by the same investors who’ve provided capital to renowned fraud Orient Paper, and its auditor is also the same as ONP’s (not to mention China Expert Technology’s). But we’ll get to these points in the future.

For now, I aim to make the case that AIC filings matter. The documents provided in this article provide an indication of what information AIC filings provide, and why investors should pay attention to them. SPRD’s AIC filings show a legitimate business that manufactures and sells semiconductors. CHBT’s AIC filings, on the other hand, show a virtually non-operational legal entity which its management has used to defraud public investors, as well as the SEC, and to raise $75m of cash from US investors.

ONP: Its Largest Supplier Is an Empty Shell Owned by the CEO

This article is about how Orient Paper’s top supplier is either non-operating or very small, and is majority-owned by its CEO. I will also discuss certain suspicious share transfers by this supplier in July 2009.

But first, I want to discuss a recent development last week. Last Tuesday, Orient Paper announced that Loeb & Loeb, the law firm it hired to run its internal fraud investigation, hired Deloitte & Touche Financial Advisory Services Limited to “assist” it with its investigation into the issues raised by Muddy Waters, LLC. Per the press release, “Deloitte will provide support to Loeb & Loeb, which is working with the Company’s audit committee, in connection with the independent review of the accounting aspects of the issues raised and the investigation of the relevant financial transactions and customer relationships.”

Deloitte is not performing an audit. It is merely “assisting” and “providing support” to Loeb in the investigation. Much hinges on what Loeb asks Deloitte to do. I’ve previously written that Loeb is not the right firm to be leading the ONP internal investigation. I do believe that Deloitte is an appropriate financial consulting firm to investigate the fraud. But it’s unclear what Loeb will ask of Deloitte, and whether Deloitte will need to sign off on any aspect of the investigation. As a result, I could certainly see a scenario where the investigation finds no wrongdoing, despite compelling evidence that the company is committing fraud.

Now, let’s move to the new evidence that ONP is falsifying its financial statements.

ONP’S Main Supplier is an Empty Shell Primarily Owned by ONP’s Chairman

According to SEC filings, ONP’s largest supplier is Xushui County Dongfang Trading Co. Ltd. (“Xushui Dongfang”). From 2006 to 2008, Xushui Dongfang is listed as ONP’s largest supplier, supplying $14.6m, $15.9m, $28.5m, and $30.7m of goods in 2006, 2007, 2008 and 2009. See the 10Ks for 2009, 2008 and 2007. Note that “Xushui County” is the same county that ONP is based in.

Yet according to third party reports, Xushui Dongfang is an empty shell company with no reported revenue. Here is a third party credit report from Qingdao Inter-Credit Services Pte Co., Ltd. (“Inter-credit”). Inter-credit is a large independent credit agency that provides a variety of credit-related services for clients. It operates out of 12 branches, and has 200 employees, including lawyers, accountants and debt collectors. It compiles independent reports on Chinese companies, using data from AIC filings and other resources – a sample report can be seen on their website here.

For any readers who doubt the authenticity of Inter-credit reports, here are their reports on China Sunergy (CSUN) and Solarfun (SOLF), both of which I believe are more accurately reflecting themselves in their SEC financial statements than CMFO, CSKI or ONP.

Here is Inter-credit’s report on Xushui Dongfang, as well as the Chinese and English translation of the information received from the Xushui AIC office:

- Inter-Credit Report on Xushui Dongfang

- Xushui Dongfang AIC information – Chinese Original

- Xushui Dongfang AIC information – English Translation

The last year in which Xushui Dongfang reported financial results was 2007. In 2007, ONP claims to have purchased $15.9 million in product from Xushui Dongfang (at the then prevailing exchange rate); however, Xushui Dongfang only reported approximately $200,000 in revenue in 2007 according to AIC reports.

Equally as important, Xushui Dongfang’s majority shareholder is none other than ONP’s Chairman and CEO. Liu Zhenyong owns 70% of Xushui Dongfang, while Li Jianjun owns 30%. Zhenyong has contributed approximately $500,000 (RMB 3.5m) of capital to Dongfang, while Jianjun has contributed approximately $220,000 (RMB 1.5m).

Naturally, ONP made no disclosure in its SEC filings that there were any related parties involved in the purchases from its largest supplier. This is likely a violation of SEC regulations.

It’s also an obvious sign of fraud. Xushui Dongfang was likely used to generate fake purchase invoices. By owning Xushui Dongfang, it is likely easier for ONP to generate fake invoices to show the auditors. Because ONP never disclosed the common shareholder, it is unlikely that ONP’s auditors looked into Xushui Dongfang. Thus, it seems that Xushui Dongfang was a vehicle to make ONP appear much larger than it is.

This revelation was first made on July 22, 2010 in the Chinese media when the 21st Century Business Herald (which is considered to be the “Wall Street Journal of China”) published an article on the allegations made by Muddy Waters, LLC. The article was the lead story for the entire newspaper that day – to see a PDF of the newspaper with the article, click here (it’s the article with the headline that contains “AMEX” and “ONP” throughout the text). The article quoted a local tax bureau official as saying that Xushui Dongfang is “just like a shell company.”

And here is the excerpt that discusses Xushui Dongfang:

In the upstream chain, this reporter discovered that a company named “Xushui County Dongfang Trading Co. Ltd” (henceforth termed Dongfang Trading Co. Ltd), according to ONP’s financial report, this company, with a (Chinese) name similar to the Company’s, has been ONP’s largest raw materials supplier since 2006.

In the three years from 2007 through 2009, this company’s supplier share is at levels of 53%, 50% and 37%, respectively.

Information shows that this company was established in 2001, registered at Xushui County AIC, and its main business is waste material collection. In the application information provided in the early stages of start-up, the company registration address contained five houses located in “Xushui County Nan He Shou Ying Village West”, and it also comes with lease contracts signed with the village committee.

This company’s initial registered capital was 500,000 yuan ($60,500 at the time), with two shareholders. The first shareholder was Liu Zhen Yong, the second was Li Chen. Li Chen once was a Director of ONP but resigned from the post in 2009. In ONP’s published documents, his drawn salary from ONP was US$4,826 in 2008 and US$4,093 in 2009. Li Chen now holds 201,164 ONP shares, which is 1.1% of shares offered.

Not long after Dongfang Trading Co. Ltd was registered, the legal representation was transferred from Li Chen to a man named Li Jian Jun and equity rose to 500,000 yuan. From what this reporter understands, Li Jian Jun is a native of Xushui. Also, Dongfang Trading Co. Ltd and the HBOP factory address are in the same place in Nan He Shou Ying Village.

“Dongfang Trading Co. Ltd in the most recent two years almost doesn’t have any revenue,” the aforementioned tax bureau insider informed me, “It’s just like a shell company.”

July Share Purchases

That’s not all.

Xushui Dongfang also somehow owned 4.4% of ONP’s shares prior to June 2009. We have no idea how it received those shares because there is no disclosure relating to it in the SEC filings prior to its sale of shares.

“On June 25, 2009 (the “Closing Date”), Orient Paper, Inc., a Nevada corporation (the “Company” or “Orient Paper”), consummated a Purchase and Sale Agreement with Xushui District Dongfang Trading Limited Company (“Xushui Dongfang”), Barron Partners, LP, Fernando Liu and Golden1177 LP (Barron Partners, LP, Fernando Liu and Golden1177 LP collectively, the “Purchasers”). Under the terms of the agreement, Xushui Dongfang agreed to sell to the Purchasers an aggregate of 2,000,000 shares of the Company’s common stock at $.375 per share, for an aggregate purchase price of $750,000. To facilitate payment and receipt of the purchase price, the Company agreed to pay or cause to be paid $500,000 or the Renminbi (Chinese currency) equivalent to Xushui Dongfang, a company organized under the laws of the People’s Republic of China (the “PRC”). In return, $500,000 of the purchase price would be held in escrow for the benefit of the Company and used to pay the Company’s current and past-due legal fees, investor relations expenses, and auditing fees of a Big 10 accounting firm to be appointed by the Company.”

What? Why did ONP’s largest supplier own 2,000,000 shares of Orient Paper, or about 4.4% of Orient Paper’s share count?

In no previous SEC filing had Orient Paper disclosed the sale or contribution of shares to its largest supplier! Xushui Dongfang was unlikely to have bought the shares on the open market, given that this normally requires regulatory approvals. Foreign equity holdings by PRC nationals and entities require approval by the State Administration of Foreign Exchange (“SAFE”).

But this is beside the point. The question remains: Why does ONP’s largest supplier feature the following?

- It had no revenue in 2008 and 2009, and only $200k of revenue in 2007

- It Is 70% owned by the CEO of ONP.

- It owned 2m shares of ONP prior to July 2009

- Why wasn’t the 70% ownership disclosed in SEC filings? The purchase of products from Xushui Dongfang (keep in mind that Xushui Dongfang comprised 30% to 50% of ONP’s cost of goods sold from 2007 to 2009) was certainly a related party transaction by ONP, and a particularly dubious one at that.

The answer to these questions, in my opinion, is that Xushui Dongfang is a shell company with no underlying business that was used as part of CEO Zhenyong Liu’s efforts to falsify Orient Paper’s SEC financial statements. It likely also aided his efforts to fabricate audit-related supporting documents (ie. invoices) to provide to its auditor.

Orient Paper: Another Fraud

I have spent much of the past month describing why I believe that China Marine Food Group (CMFO) is falsifying its financial statements. My posts and articles are here, here and here. From my posts, it should be clear that I don’t think CMFO is the only U.S.-listed RTO Chinese company that’s making up its numbers.

Another one is Orient Paper. Over the next few weeks I will explain why I believe this is the case.

Today, I will focus on a research report published by Carson Block and Sean Regan at “Muddy Waters LLC” earlier this week.

This post will summarize several of Muddy Waters’ allegations. I urge readers to read their entire report, as my brief post does not do it justice.

1. Like CMFO, ONP is using an acquisition to justify a large equity raise that it is likely using for dubious purposes, such as redirecting the funds to personal bank accounts.

On April 12, ONP announced that it had entered into an equipment purchase agreement with Henan Qinyang First Paper Machine Limited to purchase a corrugating medium paper production line with an annual production capacity of 360,000 tons for $27.8m.To fund the acquisition, ONP raised $27m in a secondary equity raise underwritten by Roth Capital Partners.

Muddy Waters wrote this:

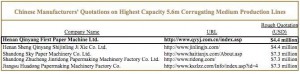

“We spoke with the purported seller of the equipment, Qinyang, and four other Chinese papermaking equipment manufacturers. Qinyang told us that its highest capacity 5.6 m corrugating medium production line (the type ONP purports to have purchased) produces only 150,000 tons per year and costs approximately $4.4 million. This stands in stark contrast to ONP’s contention that it is purchasing a single line from Qinyang that will produce 360,000 tons per year for a total price of $27.8 million.”

Qinyang further stated that no Chinese manufacturer makes a 5.6m corrugating medium line that can exceed 200,000 tons per year. Furthermore, the most expensive line was no more than $7.3m. Muddy Waters provides a table showing the companies contacted, their URLs and the rough prices of their highest capacity 5.6m corrugating medium production lines.

No company quoted a price greater than $7.3m.

In my opinion, ONP is either misappropriating 60% of the capital raise and using the remainder to purchase a line, or misappropriating all of the $27m capital raise and purchasing no line.

2. ONP also made a $5m capital raise in October 2009, allegedly to purchase digital photo coating lines owned by He bei Shuang Xing Paper Co. Ltd. But according to Shuang Xing’s audited financial statements with the Chinese government, its fixed assets were worth less than $500k.

With CMFO, we saw a similar instance where the company purchased a company for an amount far more than the target could reasonably be worth. With the case of Shuang Xing, ONP appears to be using the asset purchases as justification to raise equity, which was then likely diverted to personal bank accounts, in my opinion.

3. ONP’s SAIC financial statements show revenue, profit and assets that are far lower than their SEC financial statements, according to Muddy Waters.

In due time, I’ll publish a post independently discussing and providing ONP’s SAIC filings. But I want to mention here that based on Muddy Waters’ research, the SAIC and SEC financial statements don’t match.

The company has claimed that Muddy Waters had acquired the AIC documents for the wrong company. Muddy Waters have refuted that, and has provided evidence demonstrating their case. We’ll discuss this more in future articles.

4. Muddy Waters provide visual evidence comparing ONP’s plants / technology with competitors’ plants.

In contrast, here are pictures of two competitors’ plants.

Shandong Chenming Paper Holdings Ltd.:

Nine Dragons Paper Holdings Ltd.:

The differences between the Orient Paper plant and the competitors’ facilities are striking. The Orient Paper facilities are old, shoddy and in poor condition, whereas competitors’ machines appear far more professional and new.

There is numerous additional evidence in the Muddy Waters research report that illustrates how Orient Paper is falsifying its financial statements and inflating its assets and operating metrics in its SEC financial statements. In future posts or articles, I will elaborate on some of the financial metrics. I will also explain how the Company’s auditor, BDO Limited, is not the same as BDO Seidman, and how certain Chinese companies have been using auditors within the BDO family to trick investors into mistaking them with the more reputable U.S.-based BDO Seidman.

Disclosure: short CMFO and ONP

CSKI and LIWA

Recently, there have been several Seeking Alpha contributors that have written posts comparing the U.S. and Chinese financial statements for various U.S.-listed Chinese small capitalization companies.

The relevant articles can be found here:

Manuel Asensio and “Waldo Mushman” on China Sky One Medical (CSKI):

Steve Chapski on Lihua International (LIWA):

http://seekingalpha.com/article/203949-still-not-copacetic-at-lihua-international

http://seekingalpha.com/author/steven-r-chapski/instablog/2

In these articles, the authors compare the SEC financial statements of Lihua International and China Sky One Medical to the financial statements shown in their “SAIC” filings.

SAIC Filings

What are SAIC filings? c filings are the audited financial statements that all Chinese “foreign invested enterprises” (FIEs) must file with the local  government offices of the Administration for Industry and Commerce (AIC). The term “SAIC” refers to the “State Administration for Industry and Commerce”. These financial statements are filed annually, as part of the “Annual Inspections Report” that all foreign invested enterprises in China must submit to their local government authorities.

government offices of the Administration for Industry and Commerce (AIC). The term “SAIC” refers to the “State Administration for Industry and Commerce”. These financial statements are filed annually, as part of the “Annual Inspections Report” that all foreign invested enterprises in China must submit to their local government authorities.

Some people, including the chief financial officer of CSKI, claim that companies can file “fake” SAIC filings, whereby they materially misstate their financial statements in their SAIC filings. Based on my discussions with numerous accountants, lawyers and CFOs of verifiably legitimate Chinese companies, I do not think this is true. My understanding is that there are significant penalties for any Foreign Invested Enterprise that materially falsifies financial statements that it is filing with the local Chinese government. These SAIC audited financial statements should approximate the relevant tax filings that companies file with the Chinese government. If companies falsify their SAIC filings, they would be also falsifying their tax filings. With a company like CSKI, we’re seeing SAIC financials come in at 90%+ below their SEC financials – the Chinese government would not tolerate under-reporting and tax evasion of this order of magnitude.

As a result, the likeliest answer, in my opinion, as to why the SEC and SAIC filings are different is that companies like CSKI are falsifying their SEC filings. This is not especially difficult to believe, because the rapid growth and high margins of the companies are a bit too good to be true.

Dubious Financial Claims

CSKI has seen revenue grow from $8mm to $20mm to $49mm to $92mm to $130mm from 2005 to 2009. EBITDA margins have grown from 20% in 2006 to 38% in 2009. And what exactly does the company do? It makes a variety of traditional chinese medicines, such as the “Sumei Slim Patch”, which is a patch that people wear to foster weight loss; the “Pain Relief Patch”, which is a patch that alleviates fevers, headaches and heart dysentry; Hemorrhoids Ointments; herbal dental ulcer sprays; diagnostic kits for early stage diagnoses of heart attacks, etc. None of its products seem particularly special, and the company reports steady, rapid growth across all its segments, whether it be Patches, Ointments, Sprays or Diagnostic Kits. Read the rest of this entry »